Health Reimbursement Arrangements (HRAs) are a key part of consumer directed healthcare and employer-sponsored benefits. In recent years, HRAs have had renewed interest from both employers and workers with the expansion of HRA plan types. While a standard (group) HRA has been around since the early 2000s, the IRS added three additional healthcare HRAs since 2016. The new HRA plan types include Individual Coverage HRAs, Excepted Benefit HRAs, and Qualified Small Employer HRAs.

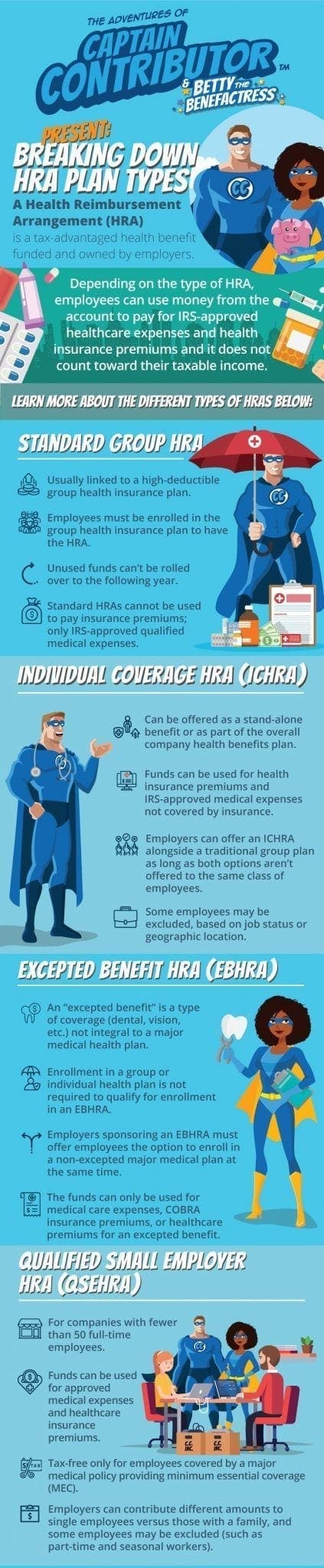

Take a look at the infographic below to learn more about eligibility, expenses, and more.

Captain Contributor and Betty the Benefactress Present: Breaking Down HRA Plan Types

A Health Reimbursement Arrangement (HRA) is a tax-advantaged benefit funded and owned by employers. Depending on the type of HRA, employees can use money from the account to pay for IRS-approved healthcare expenses and health insurance premiums. Receiving benefits from an HRA does not count towards an employee’s income.

Learn more about the different HRA plan types below:

Standard (Group) HRA

- Usually linked to a high deductible group health insurance plan

- Employees must be enrolled in the group health insurance plan to have the HRA

- Unused funds can’t be rolled over to the following year

- Standard HRAs cannot be used to pay insurance premiums; only IRS-approved qualified healthcare expenses

- Employers choose how much to contribute. There are no IRS limits.

Individual Coverage HRA (ICHRA)

- Can be offered as a stand-alone benefit or as part of the overall company benefits plan

- Funds can be used for individual (non-group) health insurance premiums and IRS-approved medical expenses not covered by insurance

- Employers can offer an ICHRA alongside a traditional group plan as long as both options aren’t offered to the same class of employees

- Some employees may be excluded, based on job status or geographic location

- Employers choose how much to contribute. There are no IRS limits.

Excepted Benefit HRA (EBHRA)

- An “excepted benefit” is a type of coverage (dental, vision, etc.) not integral to a major medical health plan

- Enrollment in a group or individual health plan is not required to qualify for enrollment in an EBHRA

- Employers sponsoring an EBHRA must offer employees the option to enroll in a non-excepted major medical plan at the same time

- The funds can only be used for medical care expenses, COBRA insurance premiums, or healthcare premiums for an excepted benefit

Qualified Small Employer HRA (QSEHRA)

- For companies with fewer than 50 full-time employees

- Funds can be used for approved medical expenses and healthcare insurance premiums

- Tax-free only for employees covered by a major medical policy providing minimum essential coverage (MEC)

- Employers can contribute different amounts to single employees versus those with a family. Some employees may be excluded (such as part-time and seasonal workers)

The Adventures of Captain ContributorTM is an award-winning employee education and engagement program run by DataPath, Inc.