FSA vs HRA vs HSA: A Comparison with Chart

Healthcare benefits accounts can be confusing. On first glance, Flexible Spending Accounts (FSAs), Health Reimbursement Arrangements (HRAs), and Health Savings Accounts (HSAs) look very similar. However, there are some significant differences between the accounts. A common question for many people is, “What are the differences between an FSA vs HRA vs HSA?”

First, let’s look at how the three accounts are alike:

- Sponsored by the employer

- Designed to ease the high cost of medical care

- Empowers people to take more control of their personal healthcare

- Provides tax advantages on contributions and withdrawals

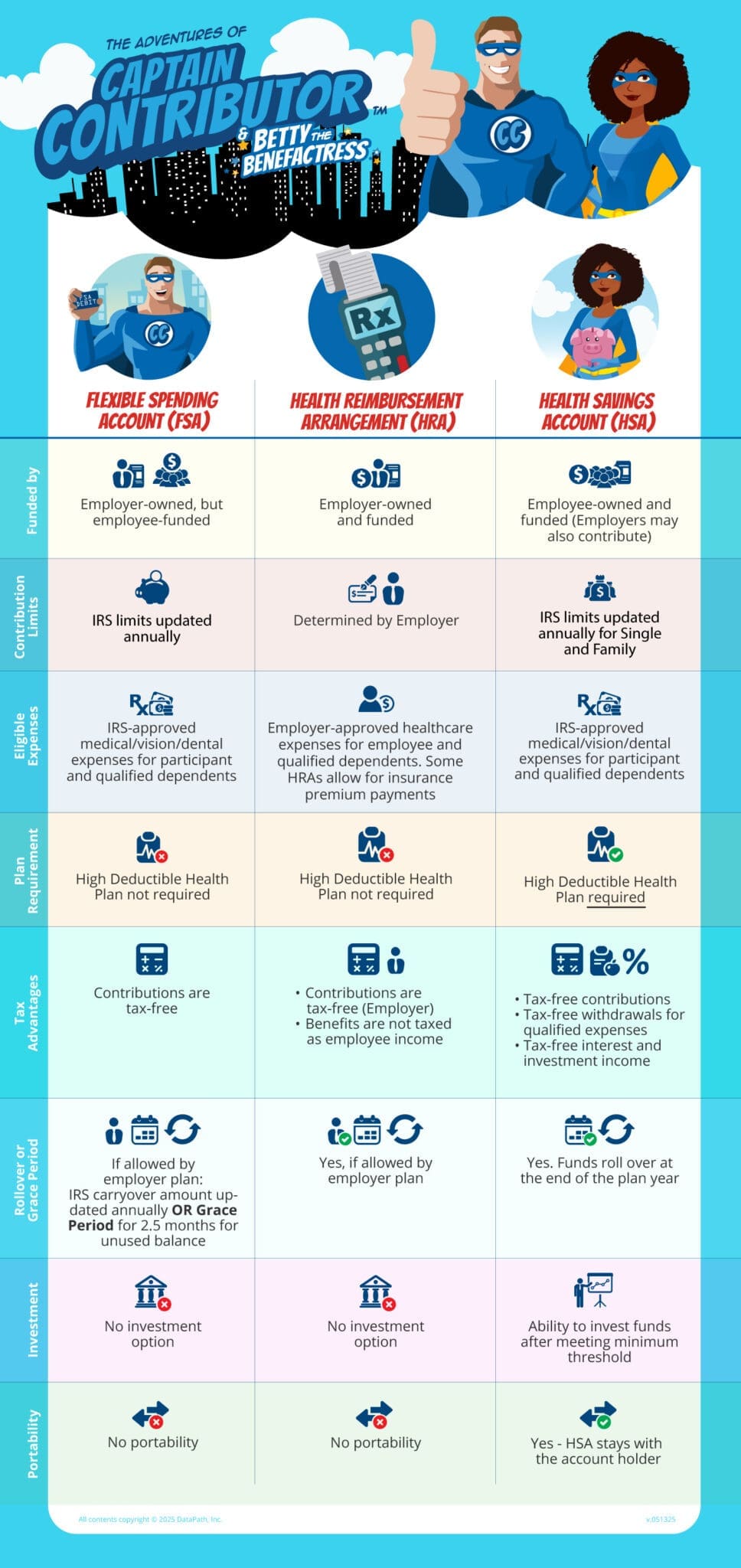

The following chart highlights the differences between an FSA vs HRA vs HSA, broken down by account.

FSA vs HRA vs HSA Infographic:

Flexible Spending Account (FSA)

Funded by:

FSAs are funded by the participant, though employers may choose to contribute.

Contribution limits:

FSA participants make pre-tax contributions (before taxes are taken out of your paycheck), which helps lower your tax responsibility. For 2025, the FSA maximum contribution is $3,300. See IRS website for more details.

Eligible expenses:

You can use your FSA to pay for a wide range of out-of-pocket medical expenses (approved by the IRS) for yourself and your dependents (i.e., children, spouse, etc.). Common expenses include prescriptions, eye care, dental care, and first aid supplies.

Rollover or Grace Period:

For unspent FSA funds at the end of the plan year, there are three options:

- Use it or lose it (all unspent funds are forfeited)

- Carryover (you can carry over up to $660 to the next year)

- Grace period of up to 2.5 months to use any leftover money

Plans vary by company, so check your plan documents to find out what your FSA offers.

Portability:

FSAs are not portable, which means you cannot take it with you when you leave your job (voluntarily or involuntarily). The account is employer-owned.

Need to know!

FSAs have a “uniform coverage rule.” That means you can use the full annual election amount on day one of the plan year. There’s no need to wait for the account balance to build up.

Health Reimbursement Arrangement (HRA)

Funded by:

An HRA is owned by and completely funded by the employer. Participants are not allowed to contribute and the benefit amount received does not count as income.

Contribution limits:

The employer determines the contribution amount in the account each plan year. There are some IRS maximums, depending on the HRA type.

Eligible Expenses:

You can use your HRA funds to pay for qualified out-of-pocket medical expenses for yourself and your dependents. The list of eligible expenses is determined by the employer (though they must be IRS-approved) and may vary from one company to the next. Learn more in this fun HRA video!

You cannot use a traditional HRA to pay for health insurance. There are 3 other HRA types that can cover insurance premiums:

- Individual Coverage HRA (ICHRA)

- Excepted Benefit HRA (EBHRA)

- Qualified Small Employer HRA (QSEHRA)

Learn more about ICHRAs and EBHRAs.

Rollover or Grace Period:

Depending on plan setup, unused HRA funds may rollover.

Portability:

An HRA is employer-owned and is not portable. When an individual’s employment status changes (due to job loss, leaving the company, or retirement), the HRA funds stay behind with the employer.

However, employers may set up a retirement HRA which allows continuation.

Need to know!

With an HRA, you generally have to pay for the expense first, then file a claim for reimbursement. Talk to your plan administrator for more information.

Health Savings Account (HSA)

Funded by:

Health Savings Account are owned and funded by the individual. Employers may contribute.

Contribution limits:

The IRS sets annual contribution and minimum deductible limits.

Eligible expenses:

You can use an HSA to pay for a wide range of IRS-approved out-of-pocket medical expenses. Approved expenses include doctor visits, prescriptions, eye care, and dental care; you can also pay for COBRA and long-term care premiums as well as Medicare Parts A and B. View a list of HSA eligible expenses.

Plan requirement:

Unlike an FSA or HRA (which have no plan requirements), you must be enrolled in a high deductible health plan (HDHP) in order to open an HSA. You must also be in a HDHP in order to make contributions. However, you can use the money even if you are not on an HDHP plan.

Tax advantages:

HSAs offer a triple tax advantage:

- Contributions are not taxed

- Withdrawals for qualified medical expenses are not taxed

- The accounts can earn interest and investment earnings, which are not taxed

Rollover or Grace Period:

At the end of the year, any unused funds rollover to the following year, allowing the account to grow.

Investment:

Account owners may invest their HSA dollars once you meet a minimum threshold (varies by plan provider). There is no investment option with an FSA or HRA.

Portability:

An HSA stays with the account owner for the life of the account. Even if you leave your employer, lose your job, or retire, the account is yours forever.

Need to know!

- Catch-up contributions: During the year account owners turn age 55, they can contribute an additional $1,000 per year over the annual limit

- At age 65, account owners can use their HSA for non-medical expenses and that money is treated as income (taxed, but not penalized).