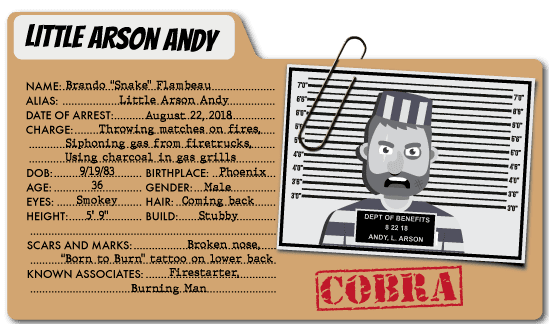

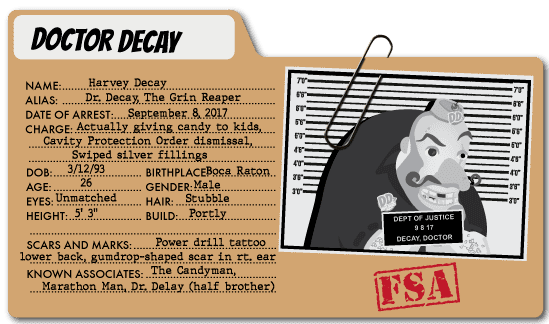

NEFARIOUS ACTIONS

1) Says if you're fired from your job, you aren't eligible for COBRA benefits.

- FALSE! Eligibility is not affected by the reason you left your job (unless terminated for gross misconduct)!

2) Says COBRA is just a scaled-down version of your previous insurance.

- FALSE! Nothing about your policy changes except the premium amount since you no longer share the cost with your employer.

3) Says COBRA doesn't cover vision or dental.

- FALSE! You can keep vision and dental if you had coverage while you were employed. However, you can pick and choose which coverage you want to keep.

4) Says COBRA coverage takes too long to go in to effect.

- FALSE! Coverage begins on the first day you were ineligible for group coverage. However, premiums must be paid before coverage begins.

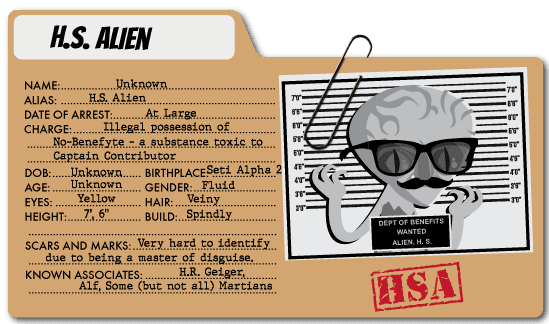

NEFARIOUS ACTIONS

1) Says HSAs are best suited for older people

- FALSE! All age groups can benefit from the triple tax savings from HSAs. You must be enrolled in a qualified high deductible health plan.

2) Says HSAs can only be used for healthcare expenses.

- FALSE! HSAs can be used to pay for some insurance premiums (such as COBRA). And after age 65, HSA owners can use them for any purpose (like a retirement account).

3) Says HSAs are the same as FSAs (Flexible Spending Accounts).

- FALSE! HSAs can be used like an FSA, but they have additional benefits:

- HSAs go with the employee if they leave the company

- HSAs have triple tax savings including tax-free contributions, tax-free withdrawals for medical expenses, and tax-free interest and investment gains

- HSA dollars can be invested to grow the balance faster

- The entire HSA balance rolls over each year

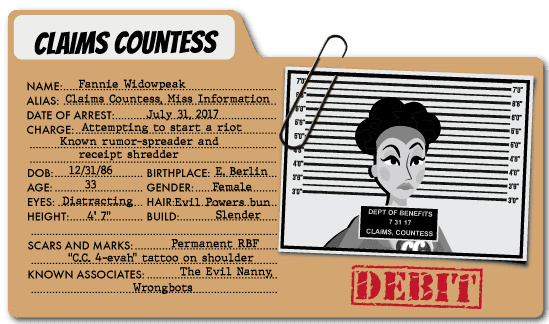

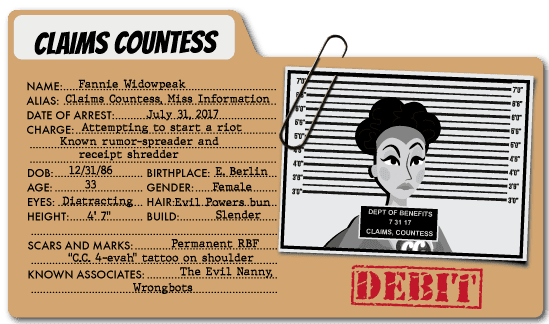

NEFARIOUS ACTIONS

1) Says using a benefits debit card means you don’t have to keep receipts.

- FALSE! While debit cards can cut down the amount of claims, you should still keep receipts in case you have to verify a purchase.

2) Says you can use a benefits debit card at an ATM.

- FALSE! Benefits debit cards can only be used for qualified healthcare expenses. They cannot be used for cash withdrawals.

3) Says you can use credit card receipts to file claims.

- FALSE! The receipt must have the date, amount, service provided/item purchased, and information on provider and patient.

4) Says you can use your debit card for gas and groceries.

- FALSE! Benefits debit cards can only be used at qualified locations (doctor’s office, clinic, pharmacy, eye doctor, dentist, etc.) for eligible healthcare expenses.

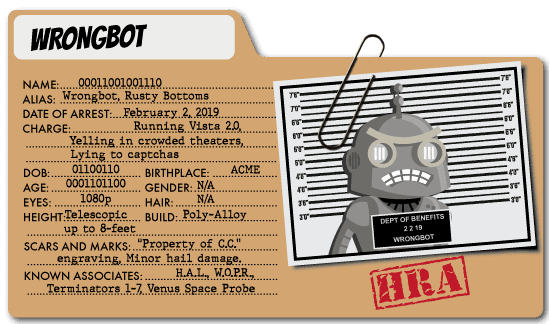

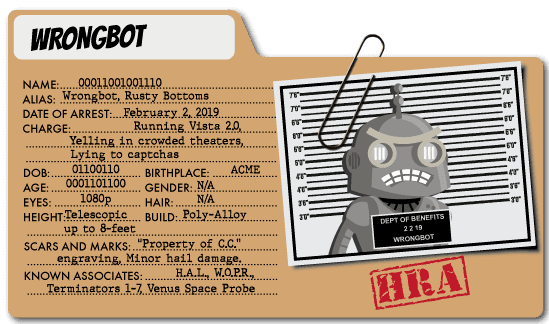

NEFARIOUS ACTIONS

1) Says HRAs count as income for the employee.

- FALSE! HRAs are a tax-free benefit funded only by the employer.

2) Says HRAs can be used for anything, including vacations!

- FALSE! Employers choose which expenses the HRA can be used for. However, the IRS only allows qualified medical expenses.

3) Says you can take your HRA with you when you leave the company.

- FALSE! The employer owns the HRA and it cannot be taken with you.

4) Says HRAs cannot cover insurance premiums.

- FALSE! Some HRAs can be used to pay insurance premiums and healthcare expenses. These include the Individual Coverage HRA, the Excepted Benefit HRA, and the Qualified Small Employer HRA.

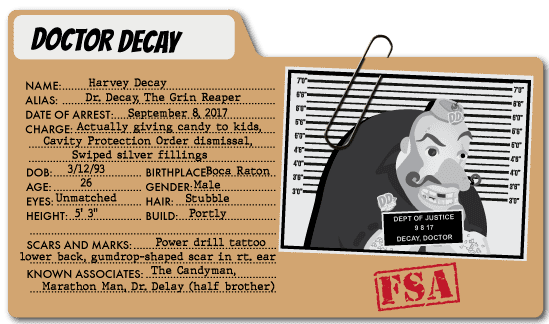

NEFARIOUS ACTIONS

1) Says you have to have health insurance to have an FSA.

- FALSE! There is no insurance coverage requirement for FSAs.

2) Says you can only use FSAs for people on your health insurance policy.

- FALSE! You can use FSAs for any tax dependent (commonly spouse and children).

3) Says you always lose any FSA money you don’t spend.

- FALSE! Most FSAs have a grace period or roll over of up to $640.

4) Says you can only spend what you have contributed to your FSA.

- FALSE! Your entire FSA election amount is ready to use on the first day. You don’t have to wait for contributions to build up.

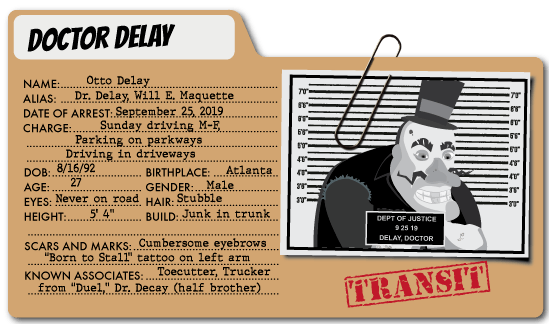

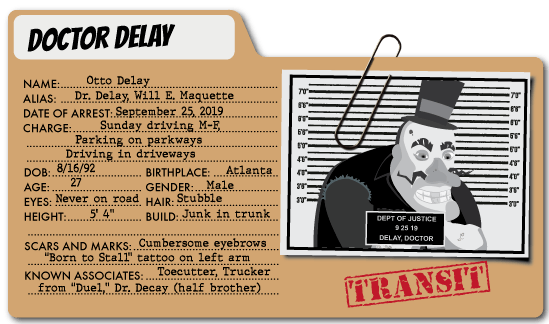

NEFARIOUS ACTIONS

1) Says you can use your Transit benefits to buy gas.

- FALSE! Your Transit benefits can only be used for bus fare, commuter train, van pool, and parking expenses to get to-and-from work. You cannot use it for gasoline.

2) Says you can keep your Transit account if you leave your company.

- FALSE! Transit accounts are not portable and any unspent balance goes to your employer.

3) Says there is no limit on how much you can spend from your Transit account.

- FALSE! There is a monthly spending/contribution limit from your Transit benefits. Once you reach the limit, you have to pay out-of-pocket.

4) Says Transit accounts are a good way to pay for speeding tickets.

- FALSE! Traffic fines are not covered by a Transit account. Slow down and obey all traffic laws.

NEFARIOUS ACTIONS

1) Says your DCAP can be used to pay for you and your spouse to go out dancing.

- FALSE! A DCAP is for care needed to allow you go to work or look for work.

2) Says your DCAP is only good for preschool.

- FALSE! DCAP funds can be used for preschools, before-and-after school care, qualified elder care, and summer day camps.

3) Says you can pay your 16-year-old to watch his little brother after school with a DCAP.

- FALSE! DCAP cannot be used to pay a relative who lives with you to provide care in your home.

4) Says a DCAP can only be used for children.

- FALSE! A DCAP can be used for dependents under age 13, as well as elderly dependents who need assistance while you’re at work.

NEFARIOUS ACTIONS

1) Says an LPFSA is limited to only prescription medications.

- FALSE! A LPFSA is limited to only qualified vision and dental expenses.

2) Says you can get your teeth whitened with your LPFSA.

- FALSE! Teeth whitening is a cosmetic procedure. Cosmetic procedures are not eligible expenses.

3) Says you can’t use your LPFSA for prescription sunglasses.

- FALSE! All prescription eyewear, including sunglasses, contact lenses, and regular eyeglasses can be covered with an LPFSA.

4) Says “fur baby” check ups are qualified expenses.

- FALSE! LPFSAs can only be used for qualified healthcare expenses for dependents of the human variety.